WhatsApp)

WhatsApp)

Dec 05, 2014· The Supreme Court has held that the government is not entitled to any mining royalty if a developer excavates land for laying foundation of a building, thus rejecting the Maharashtra government ...

India''s Most Elite Finance Legal Platform. Most utility updates, articles and posts on Indian Tax, Finance and Laws by India''s most trusted experts.

THE HARYANA VALUE ADDED TAX ACT, 2003 An ACT to provide for levy and collection of tax on the sale or ... the telecommunication network or in mining or in the generation or distribution of electricity or other form of power, provided such purchase is capitalised;

GST Latest Find Latest GST News today. We provide daily current GST information and Notifications. Today Goods and Services Tax and E way bill Updates Announcement in India.

Wikipedia is a free online encyclopedia, created and edited by volunteers around the world and hosted by the Wikimedia Foundation.

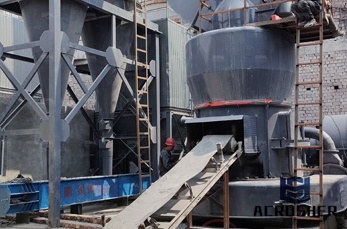

Home > Products > vat tax rate on crusher in cme mining. Mobile Crushing Plant. Stationary Crushing Plant. Grinding Mill. Washing Screening. Three in One Mobile Crusher. Mobile VSI Crusher. Mobile VSI Crusher Washer. Mobile Crusher Screen. Mobile Impact Crusher. Four in .

FORM VAT R1 [See rule 16(1) table and 41(1)] DD MM YY Original /Duplicate copy of return for the quarter ended on: 1. Dealer''s Identity Name and style of business M/S Address Contact No. TIN 0 6 Economic Activity Code 2. Gross turnover, taxable turnover of sales and computation of tax (See section

haryana town and country planning policies formining licence for stone crusher law in haryana mining licence for stone crusher law in haryana haryana town and country planning policies for stone crusher in about swot analysis stone crusher india haryana ban on isue of licences of crushers in haryana chat with support. Bare Acts Live

Feb 05, 2020· A valueadded tax (VAT) is a consumption tax placed on a product whenever value is added at each stage of the supply chain, from production to the point of sale. The amount of VAT .

Dec 01, 2009· Haryana Vat R1 1. ... (ii) In mining; (iii) In the telecommunications network; (iv) In the generation and distribution of electric energy or other form of power; (2) Which forms part of gross block on the day cancellation of registration certificate takes effect C. Paddy purchased from VAT dealers on tax invoice when such paddy or rice ...

It is further certified that the nonliability to tax under the Haryana Value Added Tax Act, 2003/ Central Sales Tax Act, 1956 in respect of goods referred to in Certificate I has not been claimed from any other person and that no other certificate for such nonliability has been issued to any other person in the State in respect of these goods.

Haryana notifies VAT at 1% on real estate developer, contractor. ... were issued to them for payment of pending VAT. A notification issued by Haryana government on September 12 states that the ...

nit no: 3/etc/2019 tender document for outsourcing of skilled manpower under excise taxation department, haryana, panchkula for fy 201920 Corrigendum to RFP for engaging Public Sector Undertaking Insurance Companies.

1THE HARYANA VALUE ADDED TAX ACT, 2003 (Haryana Act No. 6 of 2003) No. Leg. 7/2003. The following Act of the Legislature of the State of Haryana received the assent of the Governor of Haryana on the 26th March, 2003, and is hereby published for general information

TIN Business Name Principal Business Address Ward District PAN Business Style Status

Nov 30, 2018· Excise and Taxation DepartmentGovernment of Haryana has issued an Order No. 3786 dated 29th November, 2018 to extend the due date for submission of onlineVAT Annual returns for Financial Year 201718 in Form VAT – R2 from 30th day of .

Jul 21, 2013· which of the following are eligible for input tax credit as per haryana vat act. Reply. March 18, 2016 at 12:30 pm irshad shaikh says: Sir, can i take input of vat for purchase of non trading goods. Suppose i have purchased cement for office use which is not for resale. can i take input credit of vat.

Jan 06, 2010· Schedule E of Haryana Value Added Tax (Haryana VAT ... Schedule E of Haryana Value Added Tax (Haryana VAT) Schedule E of Haryana Value Added Tax (Haryana VAT) ... When intended to be used mainly in the manufacture of exempted goods or in the telecommunications network or mining or the generation and distribution of electric energy or other ...

In Haryana Value Added Tax Act, 2003, the term " Capital Goods" has been defined in Section 2(1)(g) to mean plant, machinery, dies, tools and equipment purchased for use in the State in manufacture or processing of goods for sale or in the telecommunication network or in mining or in the generation or distribution of electricity or other form ...

Nov 30, 2012· Olympic Dam Refinery Process Flow Diagram. Jul 10, 2010 · 7+ Documents Related to "Olympic Dam Refinery Process Flow Diagram" Over 500,000 Legal forms and Business Templates; Million Research and . »More detailed

Gazetteer of Haryana. The word "Gazetteer" is of Greek origin called ''Gaza'' meaning a treasury of news. It is generally understood to signify a geographical index or geographical dictionary or a guide book of important places and people.

Dear Ramesh, Physical movement of goods from one state to another state is mandatory for availing the concessional rate of tax under CST Act, this is not possible then you would have to charge full rate of tax without availing the concessional rate of tax against C Form.

Specification of Authorized officers under the Haryana Goods and Services Tax Act, 2017. : Delegation of Powers as per Section 5(3) of Haryana Goods and Services Tax Act, 2017. : Extension of time limit for submitting the declaration in FORM GST TRAN1 under rule 120A of the Haryana Goods and Service Tax Rules, 2017.

STANLEY® Engineered Fastening has the world''s most diverse portfolio of fastening products. We have been revolutionizing fastening and assembly technologies for almost 100 years. By staying at the forefront of industry technology, we ensure that our customers benefit from the most advanced fastening assembly solutions

WhatsApp)

WhatsApp)